With the United States government at risk of defaulting on its debts as soon as June 1, households, individuals, and small businesses are facing looming economic consequences that can only be avoided in time if Congress agrees on a bill that would raise the debt ceiling – a flat dollar limit on the federal deficit – which has been used as a political bargaining chip repeatedly, as it is now.

The news is full of the political machinations surrounding the debt ceiling, but it has skimped on the potential on-the-ground effects of a default.

To summarize the former, certain Republicans in the House of Representatives are trying to make raising the debt ceiling contingent on also cutting government spending.

Specifically, Republicans have proposed a stringent per-year cap in federal budget increases, and more work requirements for federal aid programs like food stamps, as well as rollbacks on increased funding for programs addressing IRS staffing, student loan forgiveness, pandemic relief, and climate change.

Spending cuts that severe would be dead on arrival in the Democrat-controlled Senate, and negotiations haven't gotten far.

According to CNN, President Biden has floated the idea of increasing the debt limit using the 14th Amendment, but the lengthy litigation that would surely follow would make it a dubious way of meeting the June 1 deadline.

The debt limit was first implemented back in 1917, as a way to give the Treasury more borrowing leeway. The Treasury was previously obligated by the Constitution to ask for congressional approval any time it wanted to issue debt.

The policy evolved further in 1939, and long story short, that was when the first flat limit was set (at $45 billion), without easy ways to adjust for inflation, economic growth, or possible games of political chicken.

Consequences

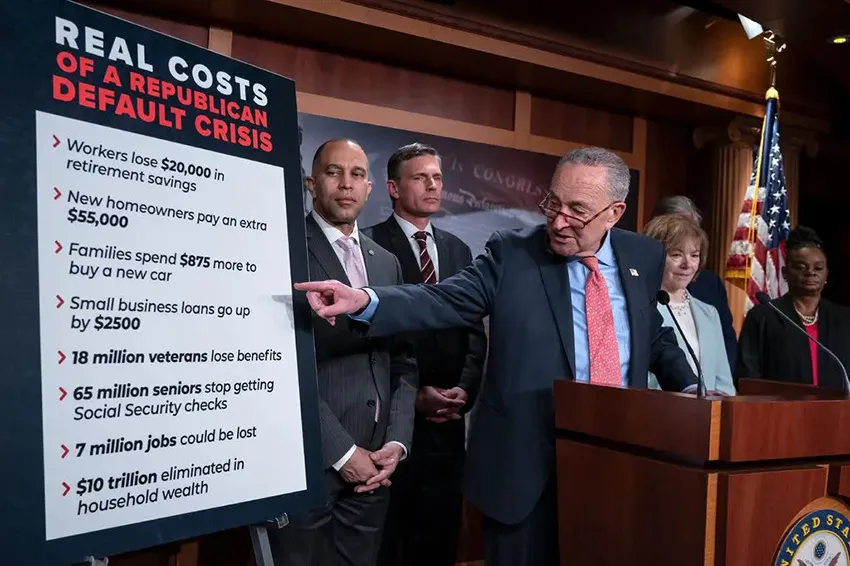

Unless Republicans in the House relent, people who depend on the federal government for either employment or assistance are bound to suffer the worst repercussions. According to the White House Council of Economic Advisors, defaulting for just a week could come at the cost of millions of jobs. Social Security payments, paychecks, and veteran benefits could be delayed, to say nothing of the ripple effects in the global economy.

CBS News spoke about the issue with Gloria Larkin, who runs a firm that helps businesses pursue federal contracts.

"We're just rebounding from COVID, etc., that so many businesses didn't even survive," Larkin said. "Now those of us who are hanging on by a thread, Congress wants us to now put up with their theatrics in threatening something they don't even need to. Oh my gosh, it's just political theatrics that they're creating anxiety at a small business level that is extraordinarily damaging to our small business psyche."

A survey by Goldman Sachs 10,000 Small Business Voices reported that 90% of small business owners believe it's important for the government to avoid default.

Of course, if Democrats were to cave and take the GOP's deal as it is, that wouldn't be good for the country's most vulnerable groups either.

Despite all that, there is something at least adjacent to good news here. The United States has never defaulted on its loans before, and leading members on both sides of the aisle have said they are determined to avoid it, which makes sense; almost 70% of Republicans in the House of Representatives represent districts with incomes lower than the national median, according to researchers at the University of Southern California.

But going through a debt ceiling crisis every few years, with all the economic volatility that comes with it, isn't some arcane economic necessity. The United States is one of two countries in the world whose government debt limit is a flat dollar amount rather than a percentage of its GDP – and the second, Denmark, has a debt limit so high it has never come even close to breaching it, and it likely never will.

In 2021, Treasury Secretary Janet Yellen said that she supported abolishing the debt limit altogether, since it could prevent the Treasury from paying for policies previously enacted by Congress.

"I believe when Congress legislates expenditures and puts in place tax policy that determines taxes, those are the crucial decisions Congress is making," Yellen said. "I believe it is very destructive to put the president and myself, as treasury secretary, in a situation where we might be unable to pay the bills that result from those past decisions."

Biden and other party leaders have said they will convene again on Friday this week to continue negotiations.